Halving is one of the most important events in the life of many cryptocurrencies, including Bitcoin (BTC), and has a significant impact on their economics, price, and ecosystem.

This process is a key element of the design of blockchains that use the Proof-of-Work (PoW) consensus mechanism and is aimed at controlling token issuance and ensuring scarcity.

What is halving and how does it work?

Halving is a programmed reduction of the mining reward for miners in blockchains that use Proof-of-Work by about half.

This mechanism is built into the cryptocurrency's code to limit its total supply and provide a deflationary model similar to rare metals such as gold.

Bitcoin as an example

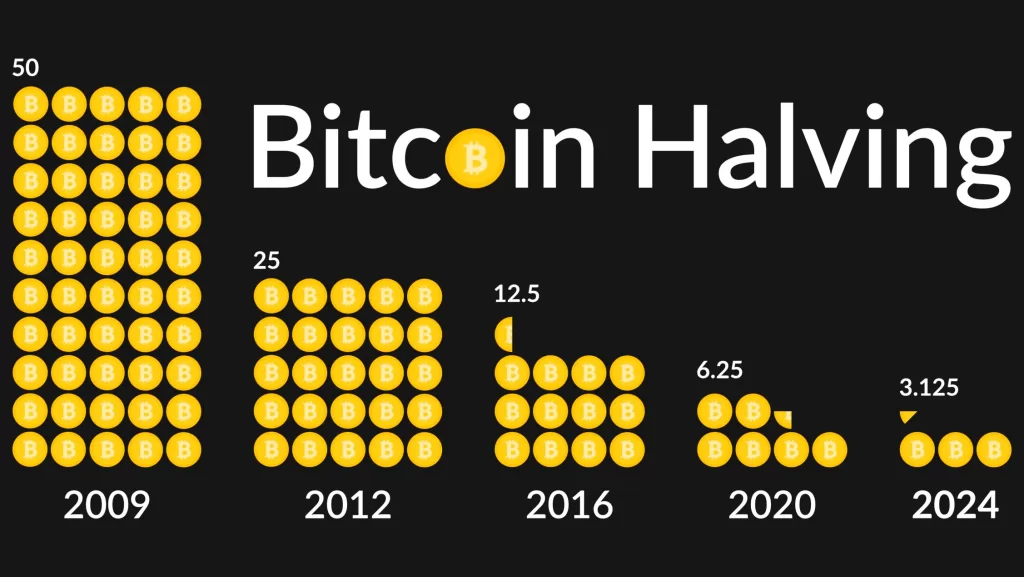

In bitcoin, a halving occurs approximately every four years (or after 210,000 blocks have been mined, as a new block is created on average every 10 minutes).

Initially, in 2009, the reward for mining one block was 50 BTC. After the first halving in 2012, it decreased to 25 BTC, after the second in 2016 - to 12.5 BTC, after the third in 2020 - to 6.25 BTC.

The next, fourth halving will take place around 2028, reducing the reward to 3,125 BTC.

The purpose of halving

Halving controls bitcoin inflation by ensuring that its total supply is limited to 21 million coins. This makes bitcoin a scarce asset, similar to gold, and maintains its value in the long run.

Technical details

Bitcoin's halving is encoded in its source code (Bitcoin Core), in particular in the parameters that determine the reward for a block.

The code is written in such a way that after mining every 210,000 blocks (approximately 4 years, given the average block generation time of 10 minutes), the reward is automatically halved.

This mechanism does not require any centralized intervention, which is one of the main advantages of the decentralized design of bitcoin.

Other cryptocurrencies with PoW, such as Litecoin (LTC), also have halving, but with different intervals and parameters.

For example, in Litecoin, the halving occurs every 840,000 blocks (approximately every 4 years), and the reward decreases from 50 LTC to 25 LTC in 2015, then to 12.5 LTC in 2019.

Historical context and market impact

Bitcoin halving has historically had a significant impact on its price and market, although the effect varies depending on macroeconomic conditions, the regulatory environment, and the level of institutional interest. Here are the key points:

- The first halving (May 11, 2012): The reward decreased from 50 BTC to 25 BTC. At the time of the halving, the price of bitcoin was about $12, but in a year (by May 2013) it rose to $120, which is equivalent to 900% growth. This growth is attributed to limited supply and growing interest in cryptocurrencies.

- The second halving (July 9, 2016): The reward decreased from 25 BTC to 12.5 BTC. The price of bitcoin at the time of the halving was $650, but by July 2017, it had risen to $2,500, which is about 285% of growth. This period coincided with the beginning of the bull market in 2017.

- The third halving (May 11, 2020): The reward decreased from 12.5 BTC to 6.25 BTC. The price of bitcoin at the time of the halving was $8,787, but by May 2021, it had risen to $58,330, equivalent to 563% of growth. This growth has been attributed to massive institutional interest (e.g., Tesla and MicroStrategy's entry) and the COVID-19 pandemic, which has stimulated interest in alternative assets.

- The fourth halving (expected in 2028): The reward will decrease from 6.25 BTC to 3,125 BTC. Price forecasts vary, but analysts suggest that this could trigger a new rally if institutional interest and the regulatory environment remain favorable.

Halving affects the market through the principle of supply and demand: a decrease in reward means that new bitcoins enter circulation more slowly, which can increase the price if demand exceeds supply.

However, the effect is not always immediate and depends on many external factors, such as regulation, economic situation, or competition with other assets.

Economic and technical impact of halving

On miners: Halving reduces miners' revenues, which can lead to consolidation in the industry. Miners with less efficient hardware (e.g., older ASICs) may leave the network if operating costs (electricity, rent) exceed revenues.

This can increase centralization if large mining pools (F2Pool, AntPool) drive out small players.

To the network: Halving keeps the network secure as miners continue to keep it running, even with smaller rewards, based on transaction fees.

As rewards decrease, the role of fees increases, making bitcoin more sustainable in the long run.

On the price: Historically, halvings have contributed to price increases due to scarcity, but the market can react with a delay (6-18 months). For example, after the 2020 halving, the growth became noticeable only in 2021.

Risks and challenges of halving

Volatility: Halving can cause significant volatility due to speculation and massive expectations. If investors overestimate the effect, it can lead to a price squeeze after the peak.

Energy impact: Criticism of bitcoin mining due to its high energy consumption (about 150 TWh per year as of 2025) may intensify after the halving as miners look for new sources of income.

Regulatory risks: Governments may respond to halving by imposing restrictions on mining or cryptocurrencies, which may affect their value.

Other cryptocurrencies with halving

Litecoin (LTC): The last halving took place on August 7, 2023, reducing the reward from 12.5 LTC to 6.25 LTC. The price of LTC increased from $70 to $110 in one year, but the effect was smaller than that of Bitcoin due to its smaller capitalization.

Bitcoin Cash (BCH): The halving took place on April 4, 2024, reducing the reward from 12.5 BCH to 6.25 BCH. The BCH price increased from $300 to $450, but the market remained volatile.

The future of halving

The next bitcoin halving will take place around 2028, when the reward will decrease from 6.25 BTC to 3.125 BTC.

This is expected to trigger a new rally if institutional interest (e.g., from BlackRock, Fidelity) and the regulatory environment remain favorable.

However, with each halving, the role of transaction fees will increase and mining will become less profitable, which may change the structure of the bitcoin ecosystem.

Halving is a fundamental part of the design of bitcoin and other PoW cryptocurrencies aimed at ensuring scarcity and long-term value.

Historically, it has caused significant price increases due to supply constraints, but the effect depends on external factors. For investors, halving is an important event to consider, but it also carries risks of volatility and regulatory pressure.

In the context of 2025, when the crypto market is experiencing stabilization after the volatility of 2024-2025, halving remains a key driver for bitcoin, but its impact may be less due to increased competition from other assets (e.g., stablecoins or tokenized assets).